STR Middle East - Market Snapshot 2022/2023

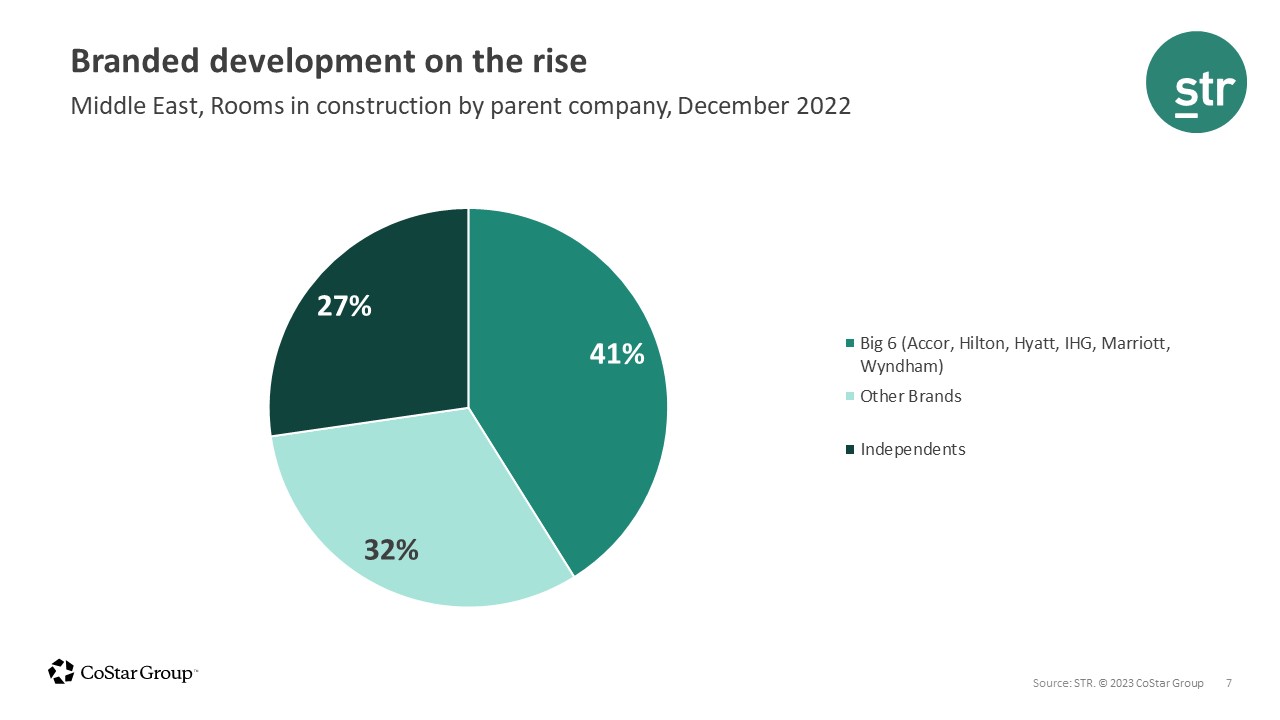

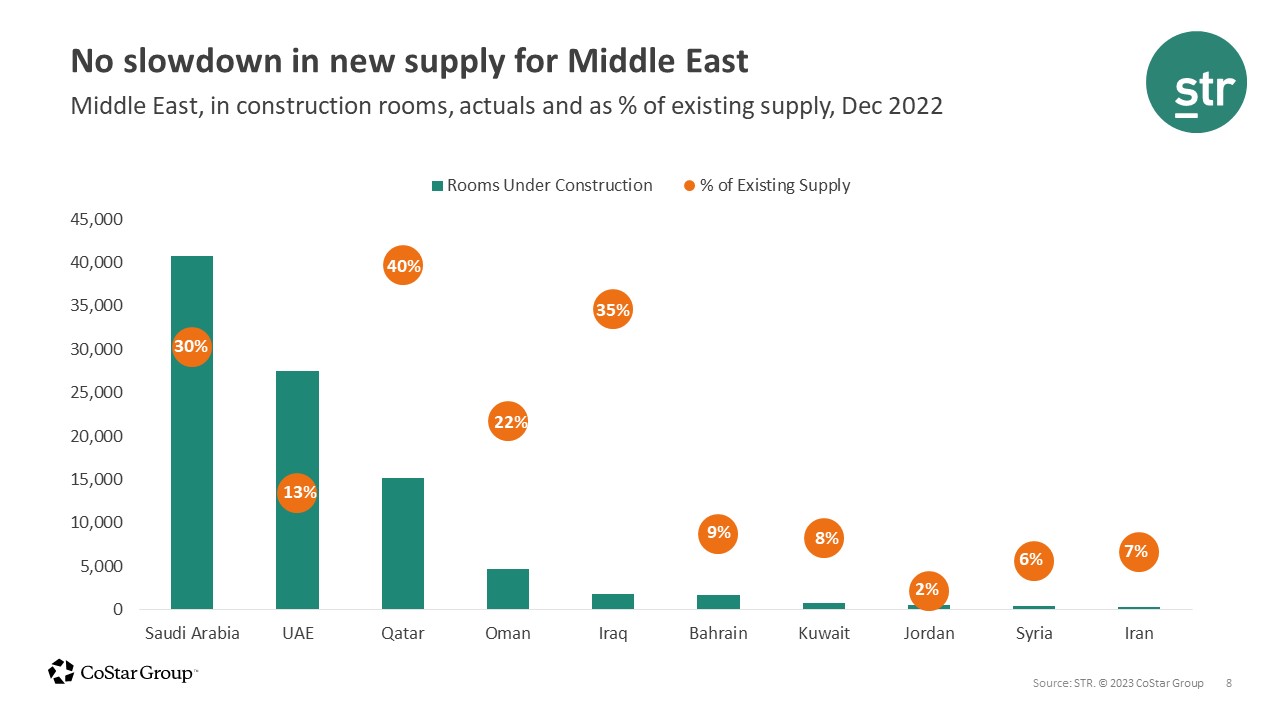

Supply growth has been the name of the game for the Middle East hospitality industry, and 2023 is expected to be no different. Ambitious plans to bolster both tourism and corporate travel across the region have led to significant development efforts from major Western hotel brands. The “Big 6” hotel companies account for nearly half of the new rooms presently under construction across the Middle East, while independently owned properties account for less than one-third of the 93,000 rooms in development. When looking at countries around the world with at least 10,000 room openings scheduled for 2023, Qatar leads in projected supply growth at 29%. Saudi Arabia (+15.3%) and United Arab Emirates (+9.8%), are third and fourth on that list, respectively.

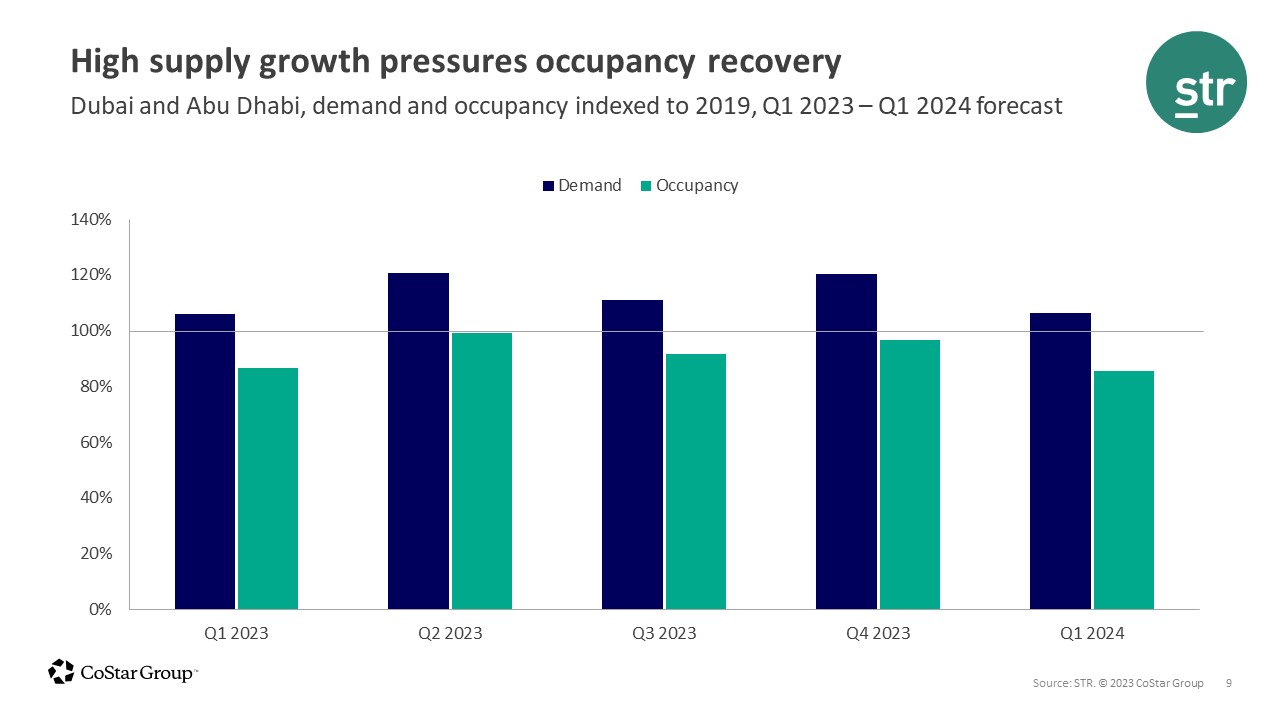

Historically high supply growth can constrain gains in both occupancy and average daily rate (ADR), but in 2022, mega events across the region as well as the continued post-COVID travel rebound helped limit the new supply impact on market performance.

The second half of the delayed EXPO 2020 in the first quarter of 2022 spotlighted popular leisure destination Dubai even as the Omicron variant surged. The market’s hotels held rates well above pre-pandemic levels throughout the year even as new rooms came online. Doha experienced a similar phenomenon during the 2022 FIFA World Cup, as both official FIFA demand and ticket holding fans flocked to Qatar’s capital.

While the host markets reported the strongest performance, the mega events’ popularity saw demand spillover into nearby markets, boosting ADR even outside of the immediate event radius. Strong regional economies further supported rate growth well ahead of pre-pandemic levels in 2022. The Middle East’s status as an oil producer helped to shelter the region from the heightened inflation that gripped the rest of the world in 2022, which meant that real ADR (adjusted for inflation) also increased substantially.

The Middle East has been the strongest around the globe when it comes to bottom-line performance, as the region reported the highest index in both TRevPAR and GOPPAR, at 114% and 120% of 2019 levels, respectively. Profit & loss performance has been stable over the latter half of the year, with each of the key markets approaching or surpassing pre-pandemic levels on a monthly basis.

Events helped propel performance in 2022, but continued supply growth, recessions in key source markets, and a quieter events calendar will create challenges for Middle East hoteliers in 2023.