STR Europe - Market Snapshot 2022/2023

European hotel performance strengthened in 2022 as recovery from the pandemic kicked into full gear despite both public health and economic challenges.

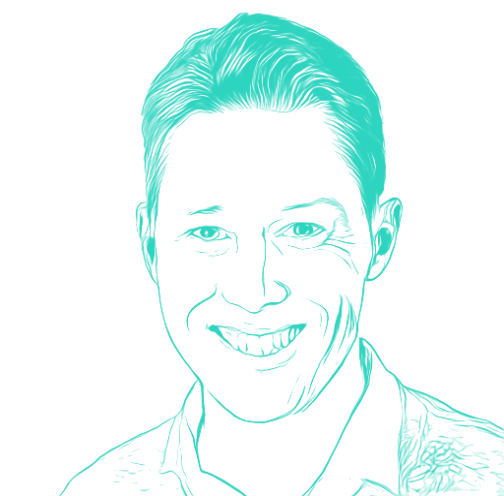

Hotel occupancy across Europe improved substantially following the end of the Omicron surge in the first quarter. Similar to 2021, leisure travel again led demand recovery. However, with COVID restrictions all but ended by mid-year, corporate demand finally started to return, and weekday occupancy rebounded rapidly over the second half of the year.

Recovery pace and drivers varied widely across markets. For some regions, such as Southern Europe, strong summer leisure travel remained the key driver. In other markets, like Warsaw and Dublin, humanitarian aid efforts arising from the war in Ukraine lifted hotel demand. However, despite the Omicron variant’s outsized impact on the first quarter of the year, most markets reported occupancy near pre-pandemic levels by year end.

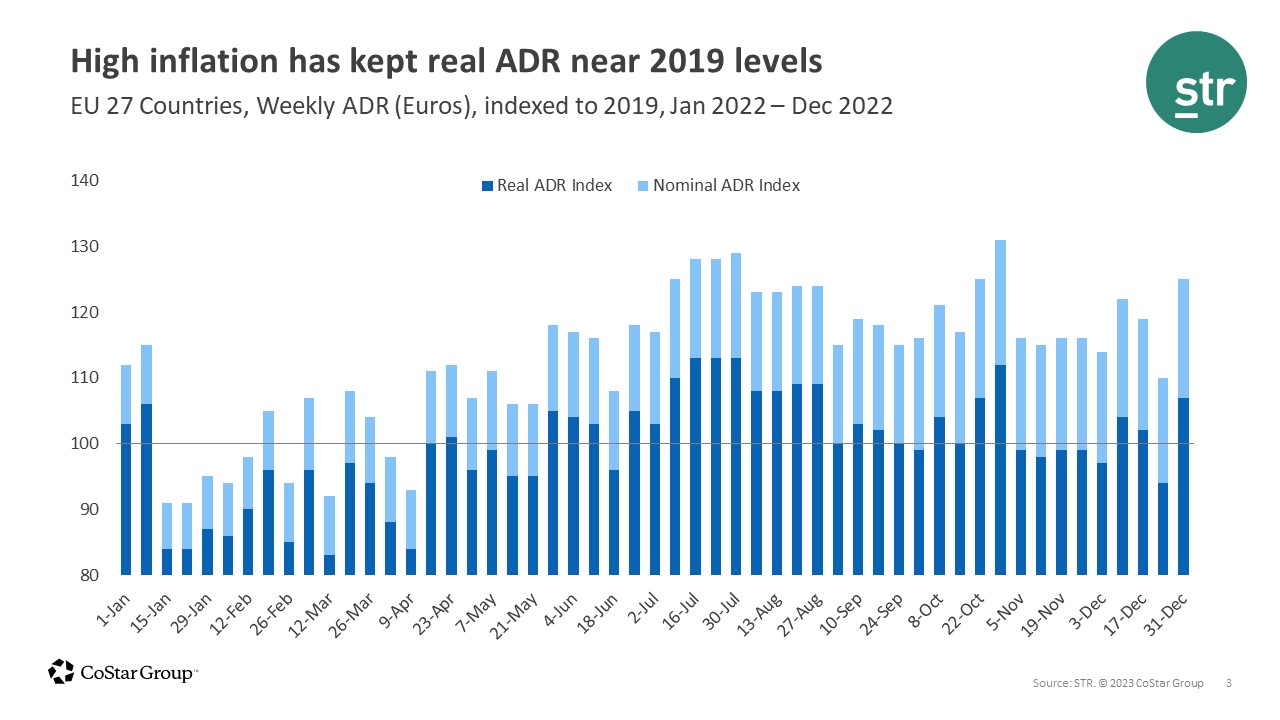

Unfortunately, as COVID concerns waned, and occupancy steadily improved, economic headwinds started to emerge. Historically high inflation across the continent contributed to a rapid rise in average daily rate (ADR) well above the 2019 comparable. Over the popular summer months, extremely high leisure travel supported by pent-up demand, savings, and a lack of COVID restrictions pushed ADR growth well ahead of inflation with temporary recovery in real ADR (inflation-adjusted). As leisure travel waned post-summer, pricing power moderated, and real ADR remained roughly in line with 2019 levels, which was a major success for hoteliers contending with rising costs.

Similar to top-line performance, the continent’s bottom-line also improved throughout the year, with total revenue per available room (TRevPAR) and gross operating profit per available room (GOPPAR) indexing at 110% and 107%, respectively. A group of key European markets (Amsterdam, Berlin, London, and Paris) realized GOPPAR improvements in 2022, all having reached the pre-pandemic comparable in the metric at some point throughout the year. Among those major markets, Paris was the only market to exceed its annual GOPPAR level from 2019 (+$13) as well as its GOP margin, while London and Amsterdam ended the year with slightly lower GOPPAR and margins than 2019.

Labor costs in the country also moved ahead of pre-pandemic levels (at 107% of 2019) due to hospitality unemployment – an occurrence across the global hotel industry.

Headwinds are expected to intensify in 2023, as sticky inflation, increased interest rates, and an energy crunch led to a mild recession for the region. Unlike prior downturns, the ongoing cost-of-living crisis is expected to limit discretionary spending, putting leisure demand more at risk than corporate travel over the coming year. Corporate-led markets are less at risk in 2023, as are markets reliant on U.S. or Middle East travelers, as the strengthened U.S. dollar supports international inbound demand from these regions.

More specifically within Europe, the U.K. and key German markets will face a challenging year. For the U.K., high inflation in the first half of the year as well as the cost-of-living crisis will be key challenges, and domestic leisure demand is expected to lag. However, major events such as King Charles III’s coronation, as well as the country’s popularity with U.S. travelers and major markets’ reliance on corporate travel will help to offset the slowdown in domestic leisure travel.

For more conservative Germany, a reliance on slower-to-return trade fairs as well moderate GDP decline will depress ADR and RevPAR in major markets over the second half of the year.