Who owns your rates? Rethinking the hotel tech stack for optimal revenue optimization

Synopsis

Cendyn's Kevin Duncan writes that hotels need to take control of rate ownership as booking patterns have shifted during the COVID-19 pandemic. Successful revenue management requires a complete understanding of search and booking data, which can be achieved by deploying a single interconnected system of Revenue Management System (RMS) and Central Reservation System (CRS).

When it comes to revenue management, every hotelier needs to ask themselves – who owns your rates? This issue of rate ownership has taken center stage, as the pandemic shifted booking patterns for hotels in ways that make it crucial for hoteliers to be in complete control of setting their own rates – and not at the mercy of channel partners.

During the earliest stages of the COVID-19 pandemic, customers felt more confident booking directly through the property’s own website. Now that travel has rebounded, another shift has taken place, and booking engines are again neck and neck with channel managers as a top source of bookings. While the GDS’ share is still much lower than it was, that’s expected to grow as business travel recovers.

Even so, the shift towards brand.com bookings has implications for how hotels allocate their inventory and optimize their rates across channels. Successful revenue optimization requires a complete understanding of search and booking data, which then offers opportunities to strengthen engagement with travelers. Here’s what hotels need to prioritize right now to optimize revenues and maintain peak profitability.

The shift in systems

While PMS was once the go-to source for revenue management, it can only show you part of the picture. Fully understanding and optimizing your search and booking data is critical for driving revenue and strengthening engagement with travelers.

However, that’s easier said than done, given the three core challenges facing revenue management today: Manual processes that are time-consuming and prone to errors; fragmented data across disconnected systems; and inaccurate forecasts that lack true insight into demand.

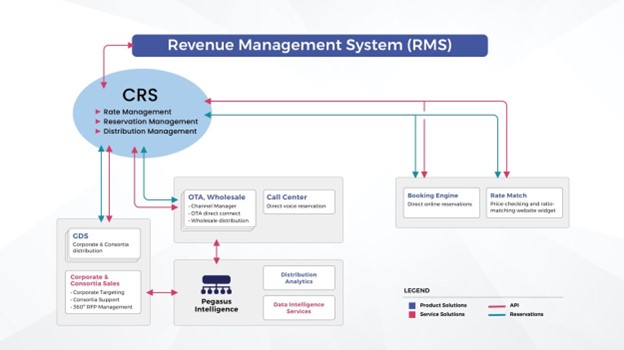

Overcoming these challenges – and taking complete control of rate setting – requires a single system with a holistic view across a hotel’s entire ecosystem. The ideal cross-functional tech stack has two components. First there’s the Revenue Management System (RMS), which supercharges profit from every segment with a total revenue management approach. Next, there’s the Central Reservation System (CRS), which optimizes demand across all distribution channels with intelligent rate setting and inventory management.

Deployed together in a single interconnected system, this technology duo seamlessly integrates rates, customer profiles and real-time demand data to efficiently optimize revenues with fewer errors, processes, and inaccuracies.

RMS ←→ CRS: The power of interconnectivity

Let’s dive into the interplay between the two parts of this duo, the RMS and CRS, which has a tremendous influence on empowering hoteliers with complete rate control.

In legacy systems, rate setting has typically been done at the property level within the Property Management System (PMS). But there’s a major issue with this approach: each time you build a rate in the PMS at the property level, you have to update it across all properties.

So, if you’ve got six properties, you’ll manually build that rate across each property, duplicating efforts and leaving room for errors. It’s also time-consuming, which discourages more nuanced rate setting in favor of blanket segments that aren’t optimized for dynamic factors, such as demand, loyalty or a guest’s willingness to pay.

It’s that last piece that really shapes the future of revenue management: rather than force revenue managers into an inflexible, frustrating workflow prone to errors, it’s time to rethink where rates fit into the hotel tech stack.

So where exactly should rates live in the hotel tech stack?

In this future-forward approach, rates live in the CRS, which is then connected directly to the RMS. So that way, rates are only loaded in a single place. With those rates, your CRS can leverage intelligent rate management tools to strengthen direct bookings and more effectively manage your inventory across channels.

And, since the CRS is where reservations and distribution are also managed, it creates a powerful feedback loop that eliminates time-consuming manual processes and reduces errors based on inaccurate data. It also more effectively optimizes revenues, as the RMS uses dynamic pricing based on inputs from the CRS to optimize total profit and unlock the true revenue potential in every booking.

Most importantly, flexible APIs and integrations provide the flexibility to adapt distribution strategies based on shifting priorities while also ensuring that the ideal rates are being distributed in the right channels.

The benefits of CRS ←→ RMS interconnectivity

By integrating your CRS & RMS data, you can create a central source of truth for setting your rates – down to the segment level. Here are some other core benefits:

- Total unconstrained view of the data

- Enhanced forecasting with greater accuracy

- Streamlined management of rates

- Ability to forecast channel bookings and/or segments

- No additional interfaces between RMS & PMS

New operation metrics for hotels

In addition to the benefits explored above, there is another major bonus to greater interconnectivity between the RMS and the CRS: better business reviews and new performance metrics for hotels.

These new metrics emerge from the ability to surface new insights thanks to interconnectivity. For instance, we can share CRS data, such as searches, with the RMS. This sync is done in real-time, which wasn’t possible when only seeing guest behavior once a booking had been made.

That creates three new metrics for revenue managers: CRS search pace, CRS search volume and CRS conversion rate on a segment and channel level. Those metrics provide a direct line of sight into price elasticity, and thus a new – and extremely powerful – revenue optimization lever.

Other new metrics include hotel ranks in search, as well as rate position and market share by channel. There are also two competitor insight metrics, with competitor ranks and competitor search rates providing core competitive intelligence for how competitive your rates are among your compset.

What’s next for total revenue optimization

The complexities of revenue management are especially acute for larger properties and multi-property organizations. These groups benefit greatly from a single source of truth for data, presented in a single dashboard across all departments.

Of course, there’s still a lot of work to do when it comes to integrating disparate systems and building the type of interconnectivity that drives better business outcomes. Investing in transformational change takes time and it takes agility.

To prepare for what’s next, start with a data audit; understanding how data is utilized today is the first step to knowing where that data analysis needs to be for future competitive advantage. We’ve all become data wranglers – and the better we get at pulling together disparate data into an actionable framework, the more successful we’ll be at achieving our goal of total revenue optimization!